In this post, we’re looking at confirmation bias. We also talk to Rachel Alberts, a social media expert, about something called the echo chamber effect and feedback loop we get stuck in. With the rise of social media and fake news, it is imperative that we understand how confirmation bias and cognitive dissonance thrive in the media we consume. To help, we’ll end with some useful tips on how to break out of your social media echo chamber.

We’re going to get into the detail of the social media echo chamber effect. But before doing so, we need to do a quick rundown of confirmation bias and cognitive dissonance. Catch this episode on our YouTube channel or listen on your favourite podcast platform.

As the name suggests – with confirmation bias, we go looking for information that confirms what we already believe. We also go a bit further than that and actively avoid evidence that might be contradictory to our opinion.

In a previous post, called “Why you can’t argue with a vegan” we discussed an example of confirmation bias in the food industry. And yes, that’s exactly why you can’t argue with a vegan. It’s why our ancestors believed the earth was flat for as long as they did! It’s also why some people believe it again today!

But consider someone investing in shares in a company. You might feel very strongly that a particular company holds the same ideals and values as you, making it a place where you want to invest your money. And you feel confident about that decision. Suddenly an article comes out that the company has been cutting corners and isn’t as moral as it appeared to be. It’s much easier to brush off that article as being sensationalist rather than engaging with the news and looking for other sources to see if the story holds true.

In a previous post, called “Why you can’t argue with a vegan” we discussed an example of confirmation bias in the food industry. And yes, that’s exactly why you can’t argue with a vegan. It’s why our ancestors believed the earth was flat for as long as they did! It’s also why some people believe it again today!

But consider someone investing in shares in a company. You might feel very strongly that a particular company holds the same ideals and values as you, making it a place where you want to invest your money. And you feel confident about that decision. Suddenly an article comes out that the company has been cutting corners and isn’t as moral as it appeared to be. It’s much easier to brush off that article as being sensationalist rather than engaging with the news and looking for other sources to see if the story holds true.

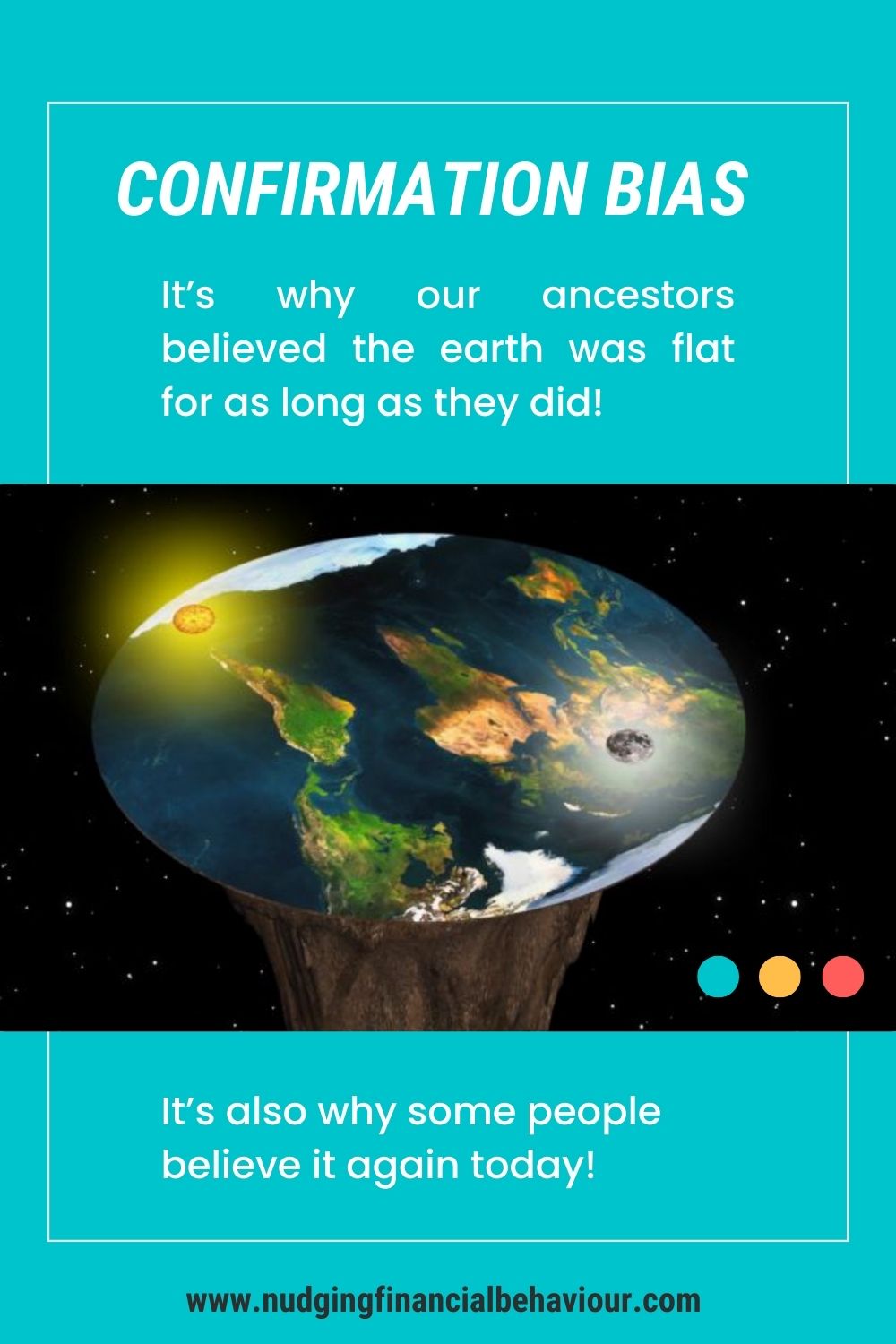

We all seek out and process information supporting our confirmation biases. Share on XNow let’s consider a cognitive bias known as cognitive dissonance. Basically, we seek consistency amongst our beliefs or opinions (also known as our cognitions). Dissonance occurs when there is inconsistency between our cognitions.

As humans, we don’t like being in a state of dissonance and we look for ways to reduce or remove it from our lives. In order to do this, we rationalise situations that aren’t good for us.

Let’s think specifically about our money decisions… you’d like to and want to build up your savings… BUT… you tend to spend extra cash as soon as you get it. Now… when you’re faced with a sudden, unexpected expense and you don’t have the money for it, you regret spending all that extra cash. That regret and discomfort you feel is because of the dissonance… and that’s cognitive dissonance for you.

There are two solutions to cognitive dissonance. You can change your actions – remind yourself that spending your extra cash straight away isn’t going to help you achieve your goals.

Or, you can change your belief and tell yourself something like “you don’t earn enough money to make saving worth it”. From here, you have given yourself permission to keep acting the way you’ve always acted.

So, the big question is – how does confirmation bias and cognitive dissonance impact our financial decision making? The truth is that confirmation bias limits you. It also leads you to make decisions without getting all of the information first.

Thanks to the internet and our media consumption, as well as search and social media algorithms, confirmation bias has become rampant. The online world is a breeding ground for confirmation bias.

We tend to look at websites, blogs, youtube channels, and social profiles that mirror our views. The search engines and the social media platforms start to learn from your browsing and engagement activity. They then serve up adverts and suggestions for other profiles to follow based on your interests.

This continues to reinforce your beliefs as you find more and more likeminded individuals online. Your circle of information resources and exposure may widen, but the actual information and content you’re getting becomes narrower and narrower.

What is an echo chamber in media? We tend to look at website, blogs and social profiles that mirror our views. In doing so, our circle of information widens, but the actual information we're getting becomes narrower and narrower. Share on XYou end up in a social media echo chamber over time where everyone around you has the exact same opinion. I know… it’s difficult to overcome the bias when the algorithms also work against you (thanks Facebook). Although, you could argue that it’s not really Facebook or any other social media platform’s fault when you consider the fact that these platforms were designed to bring likeminded people together. Perhaps it’s the media literacy of us, as users, that we need to pay more attention to.

We chatted to Rachel Alberts, digital media lead at one of the top retailers in South Africa, to tell us a little bit more about these online echo chambers and where this concept first came from in social media.

The first time we saw social media… MySpace in the early 2000’s and Facebook shortly after that, is when we first saw echo chambers. Before social media, the sorts of internet platforms we were using were blogs or forums where you couldn’t really decide who you wanted to talk to. That was kind of up to someone else. It was up to the internet provider or it was up to the website you were using.

The existence of social media like we know today… Facebook and Instagram… and to a less extent Twitter, you choose who you want to be in your bubble. That’s where it all began. When we were the ones making the decisions about who we want to hear from and who was going to hear from us.

We need to remember that these platforms were designed to bring likeminded people together. It’s what we want to see, what we want to hear. But heed Rachel’s words on why this is something we should be concerned about. In particular, the echo chamber social media example that she gives.

I think the trend we’re seeing across the world is that humanity is becoming very contrasted. We’re seeing extreme opinions being shared, particularly on social media. And that means that people are less interested in finding out more about things that don’t necessarily appeal to them directly. There’s a lot of danger in only valuing the opinions of people who have a similar mindset or maybe even a similar background to you.

It also means that when you are constantly surrounding yourself with one kind of opinion, you’re more susceptible to misinformation or even fake news because you are hoping that what you already feel [is supported] and that’s so human… to want to be right. You’re exposing yourself to the same sort of opinions over and over again. And we’ve seen the real world effect of that with the alt-right: storming the Capital, hate crimes against minority groups, and stuff like that.

These are some very serious corners. And social media echo chambers and political polarization aren’t helping any of them. Furthermore, we know that the best form of decision making happens when you have diversity of opinion in a room. So, if you don’t have that diversity, you don’t have the best decision making.

We asked Rachel to give us some tips. Because we know that it’s so tempting and it’s so much easier to only talk to people who think like you. So, how do we go about breaking this confirmation bias feedback loop that we tend to get into? Here’s what she said:

I’ve been thinking about this a lot lately in my own life. It’s something that I’ve been trying to actively remove myself from.

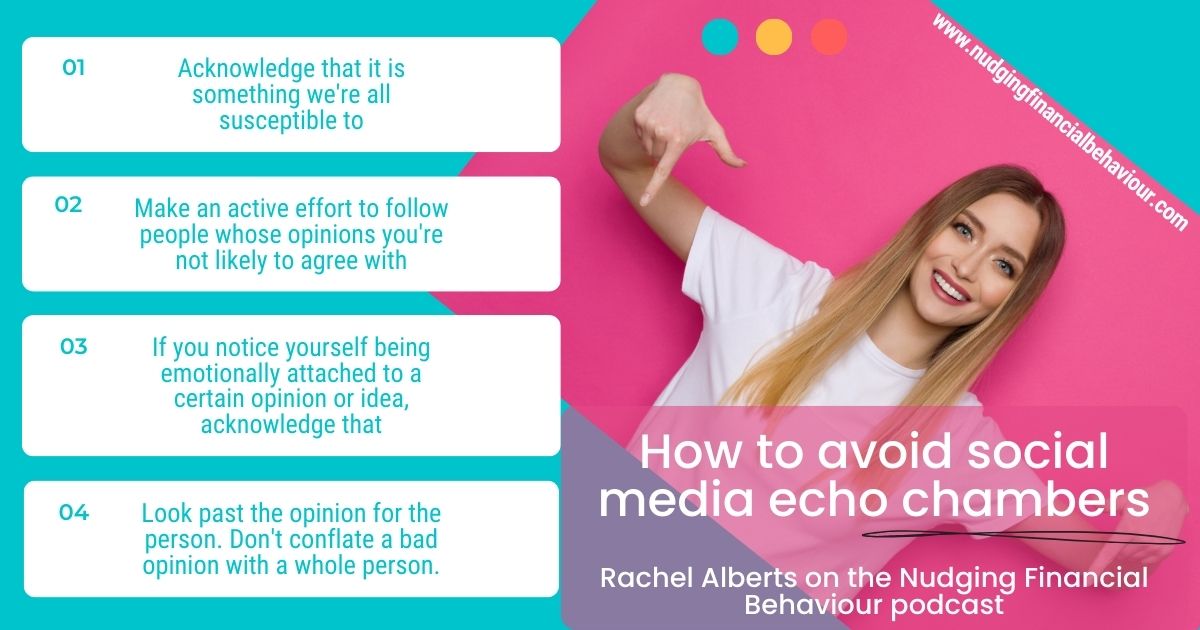

I think the first thing is self-awareness and to acknowledge that it is something that we’re all susceptible to. I think anyone watching this interview [or reading this blog] is probably in the right space already. If you’ve opened your mind up to learning something new, you’re already on the right track.

My number one tip is to make an active effort to follow people whose opinions you’re not likely to agree with. This is hard, let me be honest about that, it’s not an easy thing to subscribe to someone who is always sharing information that you don’t agree with.

The other thing is if you notice yourself being emotionally attached to a certain opinion or idea, acknowledge that. I’m going to use vaccines as an example, which we know were so controversial when they came out. We saw a lot of information in both directions. [You need] to take a step back and to find the expert opinion, which is not always you or your friend on Facebook, and to look for resources that are trusted… there’s actual research that goes into those sorts of opinions

And then my last tip is a little left field. I was having a conversation with someone recently and we were talking about a friend of ours who has these opinions that we don’t necessarily agree with. The lesson I want to share there is that it’s really easy when you have a friend who has an opinion you don’t agree with to look past the opinion for the person. But on social media it’s not as easy. We tend to conflate a bad opinion with a whole person. Just because someone has an opinion that you don’t agree with doesn’t necessarily mean they’re a bad person. [We need] to be compassionate for the person on the other side of the screen.

Some really good tips. Not easy to do, but definitely worthwhile trying our best.

I’m sure you’re starting to notice a trend – these biases are intrinsically part of us so they’re not easy to combat. However, being aware of the influence that they have – and being aware of the influence that the outside world can have on our decision making – can really help.

I would also advise you to not get your tips or information for investments from Facebook!

Narrow framing – Narrow framing, the compromise effect, glossing, and the enabling frame. We need frames to make sense of the world. But they cause problems.

The anchored trader – Anchors tie us down and can have serious consequences for investors and traders. Don’t be the anchored trader.

Let us know in the comments below.

All rights reserved. Regarder cette vidéo activez javascript dans javascript dans votre dans votre navigateur.

I am passionate about helping people understand their behaviour with money and gently nudging them to spend less and save more. I have several academic journal publications on investor behaviour, financial literacy and personal finance, and perfectly understand the biases that influence how we manage our money. This blog is where I break down those ideas and share my thinking. I’ll try to cover relevant topics that my readers bring to my attention. Please read, share, and comment. That’s how we spread knowledge and help both ourselves and others to become in control of our financial situations.

Dr Gizelle Willows

PhD and NRF-rating in Behavioural Finance

[user_registration_form id=”8641″]

“Essentially, all models are wrong, but some are useful.” – George E.P. Box

Receive gentle nudges from us: