Student loan debt and a pending credit card payment… we all know how debt can often spiral out of control. What doesn’t help is how our lifestyle creep often leads us into debt temptation. And then we ending up with insufficient savings and overdue payments.

But fear no more – in this post we’re going to give you some tips on how to stay away from dodgy debt. If you already feel like you’re in too deep though, we’ve got some useful tips from a credit counselor that can help you with a debt consolidation loan and prevent the debt collector from knocking on your door. Know how to manage your debt ! Here’s what we’ll be discussing in this post:

Before we start unpacking these common pitfalls that get us into financial trouble, make sure you’ve read our post on financial literacy. We covered some basic financial terms you need to have under your belt. Once you’ve done that, you’ll be ready to join us here. As a reminder, it’s important to understand each of these pitfalls before we start talking about our biases. We need to cover this groundwork first, specifically, how to manage your debt and save. Then, we’ll unpack the biases one by one.

You can get straight into it by watching the episode below. Please subscribe to our YouTube channel so you get alerts for future episodes. You can also listen to the episode on your favourite podcast platform or just keep on scrolling to read further.

This essentially refers to spending on non-essential items – going out, clothes, accessories, gadgets, the little (or sometimes big) luxuries that contribute to our standard of living. The thing is, as you get older and as you earn more income, this spending goes up – and sometimes this increase doesn’t match what you’re earning. This is when you hit a point of overconsumption.

Another major reality of lifestyle creep is that as we get older, we tend to have more dependents and responsibilities. You get married, have kids, a parent gets ill and needs taking care of, you buy a house and need to payback the home loan, you need a car, etc. All of this raises a burden on your finances that is unavoidable – and it’s often something that you don’t want to avoid anyway.

All we’re saying here is that lifestyle creep is something you need to be acutely aware of. When you get a raise at your job, your first thoughts shouldn’t be about all the new things you can buy. Rather, think about taking at least some of this extra money and investing it or putting it into a savings account for the future.

The scary thing about lifestyle creep is that you often don’t realise it’s happening to you until it’s too late. Share on XOne of the biggest problems we face in today’s world is that debt is so freely available – making lifestyle creep very easy. And if your financial literacy is not up to scratch, it makes it very easy to get caught up in debt you don’t understand properly. What’s worse is that the nastier the debt and the higher the interest rate, the easier it is to get.

The nastier the debt, the easier it is to get! Share on XSome warning signs for debt you should never get:

Now, don’t get me wrong – debt isn’t always a bad thing. There is a place for it. And not all debt is dodgy debt. But you do need to make sure you can service whatever debt you have. Debt management plans can help with this. If you cannot afford to pay it back within the timeframe that you’re expected to pay it back, you’re going to make life very difficult for yourself. By this I mean… what is the interest rate that you’re being charged? And how quickly are you expected to pay it back?

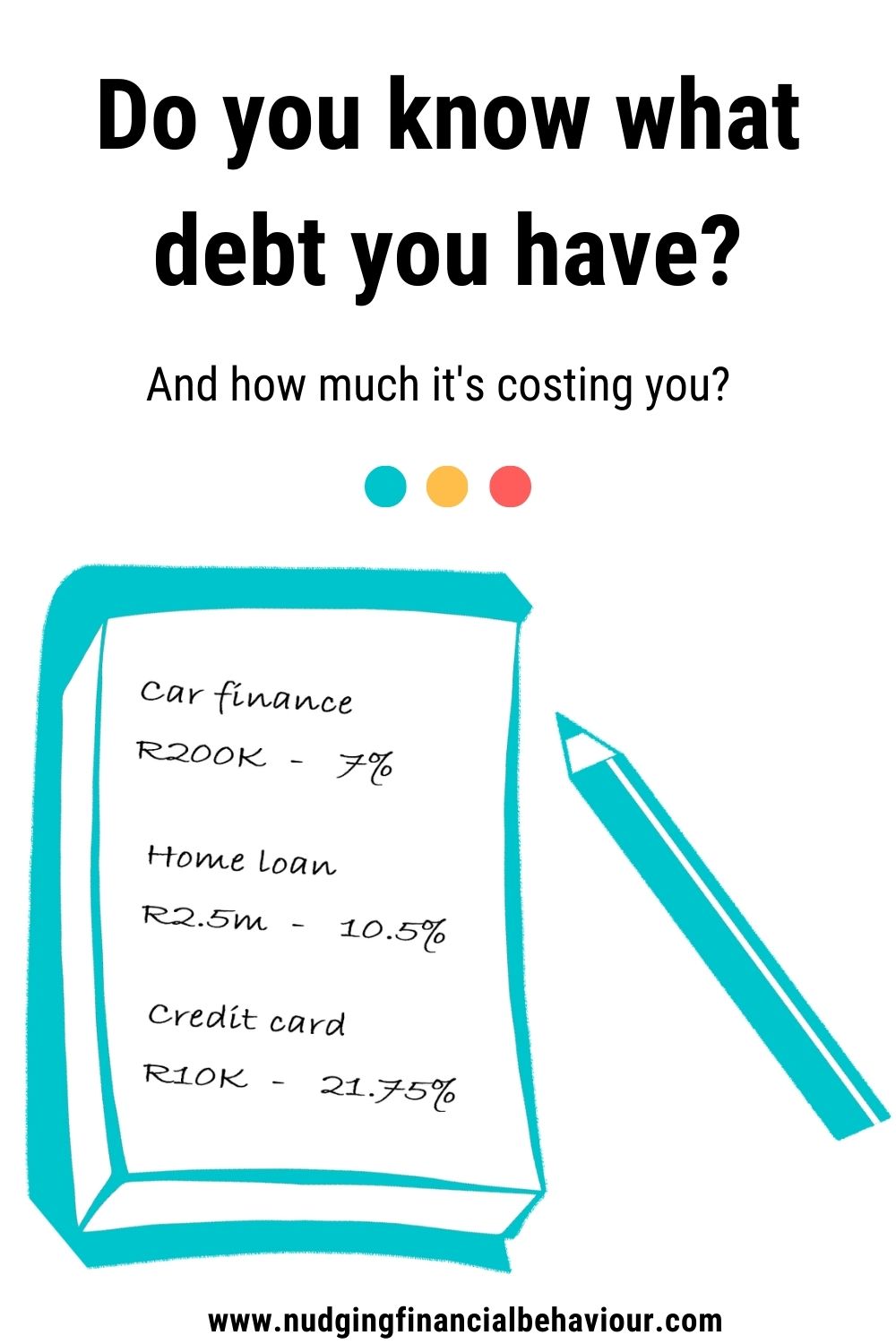

Do a little exercise for yourself…. Make a list of all your debt…. Put the rand amount that you owe next to each of them and then put the interest rate you’re being charged next to that.

I’m actually more interested in the interest rate number than the actual balance owing, because that’s telling you how expensive the debt is. If you’re seeing percentages over 15%… that’s really expensive. Can you perhaps negotiate a lower interest rate?

Things like payday loans, personal loans, store cards, loans to buy furniture and electronics (known as hire-purchase), credit card balances and overdrafts (when you get beyond the interest free days) – if you owe money on these types of debt you need to pay them off first, as quickly as possible. And if you’re reading this and thinking you have no idea what interest rate you’re being charged, well then this is an even more important exercise for you to do! Don’t be an ostrich. Get the information. Know and understand what debt you have!

If your debt is extensive. And you don’t have the disposable income to pay it off, know that you can apply for debt consolidation or debt relief. This is when you get a company to consolidate everything into one debt that you pay off over time. During this time, you can’t apply for new debt, but you will be protected from legal action.

We chatted to Nadia de Weerdt from the Debt Counsellor’s Association of South Africa to get a better understanding of the debt and credit counselling process:

Debt counselling is a legal process that protects consumers from over-indebtedness. You apply for debt counselling as a legal way of repaying your debts in an affordable manner, reducing the interest and cutting out fees as much as possible.

It gives you a bit of breathing room to just sit and go, okay, the debt is on this side, my expenses are on that side, I can manage!

She also gave a great tip on how to avoid getting into a debt spiral with credit cards:

When you sign up for credit card debt, there’s usually a little box that you can check which gives the credit provider the right to annually increase your credit card limit. As the years pass, that limit can increase so much that it becomes higher than your salary. So – don’t check that box!

Debt counselling is quite a process, it has its downsides, but if you’re in a truly hopeless debt spiral, go speak to a debt counselling company and see if they can help you with a debt management plan.

Before we finish our discussion on debt and credit counseling though, I just want to go over a few extra things that you need to be wary of:

A few other things we should all be careful of include anything with convoluted payment methods or offers that don’t come with a clear business model.

Okay, enough of how to manage your debt. Let’s move onto the stark reality of not having sufficient savings (eek).

When you combine overconsumption and being debt-burdened, you get a trifecta of worry. Getting into debt is the easy answer when it comes to paying for your lifestyle creep. The major problem when you’re spending most of your disposable income on debt settlement and things you don’t really need is that you tend to reach a point where you don’t have sufficient savings to live off if something goes wrong.

Waiting until there is a problem with your finances to start saving is not very helpful. Saving money and planning for later in life is not something you should ever wait to start doing. The right time to start saving is right now – even if it’s only a little bit that you’re saving now.

The right time to start saving is RIGHT NOW Share on XIt doesn’t matter how old you are or how much you can save – in order to start saving, the important thing is the habit. And it’s never too late to start a new habit. You NEED to get into the HABIT of saving first. Then you work on putting away more and more as you get older.

In order to start saving, the important thing is the habit. And it’s never too late to start a new habit. Share on XAnd of course, the younger you are when you start, the better. But even if you’re already older in age, every little bit helps. Start now!

If you recognise any of the behaviour we’ve discussed in this post in your own spending habits, don’t stress – you are definitely not alone. It’s also not too late and it’s not impossible to change those habits. That’s what we’re here to do, nudge you into making better financial decisions. At the very least, to know the importance of managing debt.

There are so many resources out there to help you make smarter, more rational decisions about your money. For example, you can always check if a company has a registration number with the Financial Services Board. And there are also many websites that can generate a credit score and credit report for you. Ensure you know how to deal with debt stress and how to manage your debt effectively.

Remember the tips we’ve given on avoiding over-indebtedness and stick with us as we help you navigate these pitfalls that can so easily get ALL OF US into financial trouble.

Want to pin this post for later?

[apsp_save_button type=’one-image’ shape=’rectangle’ size=’large’ save_url=’www.nudgingfinancialbehaviour.com/how-to-manage-your-debt’ save_image=’https://www.nudgingfinancialbehaviour.com/wp-content/uploads/2023/06/dealing-with-debt.jpg’ image_description=’Lifestyle creep and easily available debt can easily lead to overconsumption and insufficient savings. Let us help you learn how to manage your debt.’]

Narrow framing – Narrow framing, the compromise effect, glossing, and the enabling frame. We need frames to make sense of the world. But they cause problems.

The anchored trader – Anchors tie us down and can have serious consequences for investors and traders. Don’t be the anchored trader.

Let us know in the comments below.

[apsp-follow-button name=’nudgingfinancialbehaviour’ button_label=’Follow on Pinterest’]

I am passionate about helping people understand their behaviour with money and gently nudging them to spend less and save more. I have several academic journal publications on investor behaviour, financial literacy and personal finance, and perfectly understand the biases that influence how we manage our money. This blog is where I break down those ideas and share my thinking. I’ll try to cover relevant topics that my readers bring to my attention. Please read, share, and comment. That’s how we spread knowledge and help both ourselves and others to become in control of our financial situations.

Dr Gizelle Willows

PhD and NRF-rating in Behavioural Finance

Receive gentle nudges from us:

[user_registration_form id=”8641″]

“Essentially, all models are wrong, but some are useful.” – George E.P. Box