At retirement, you need to purchase an annuity. And you have two choices: either a living annuity or a guaranteed annuity. Or – you can have a bit of both.

Each of these options has its own set of advantages and limitations, so we’re dedicating separate posts to each of them. Up first – we’re talking about LIVING annuities.

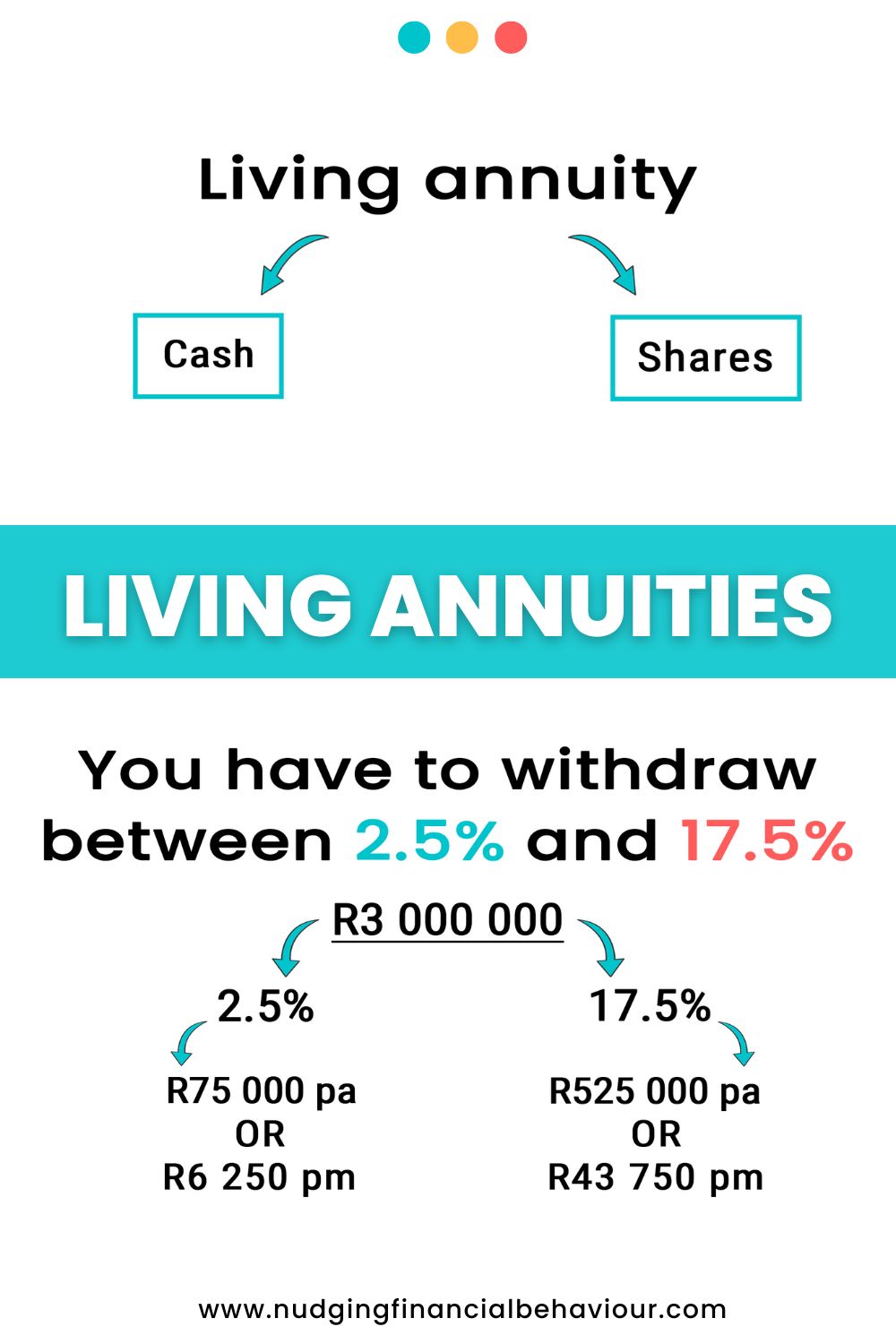

With a living annuity, it’s much like investing in an investment portfolio. Your capital is used to buy different types of assets. Suitable assets with an appropriate risk profile, right?

In addition to investing the money – you need to pay yourself a salary from that investment portfolio. So, you invest that capital lump sum and then specify a certain percentage of that to be paid out to you each month. That percentage is commonly referred to as your drawdown percentage. It’s the percentage that you’re withdrawing, or drawing down, from your living annuity.

Legally, you are forced to withdraw money from your living annuity: between 2.5% and 17.5% of your investment. But the implications of how much you withdraw can have a significant impact on how long your money will last.

In the video below we unpack this in more detail. And we go through various examples which show you how different drawdown percentages work and what impact they have.

The nice thing about a living annuity is that you have control! And then of course, often the biggest pull towards a living annuity is that the money remains in your ownership. When you die, your beneficiaries can inherit it, provided there actually IS money left over. If you’re withdrawing too much during your lifetime, there isn’t going to be much left to leave to your beneficiaries.

With living annuities – the most important thing is that you understand the implications of how much you’re withdrawing each year. Share on X

If you haven’t done so yet, subscribe to our YouTube channel.

Deciding which annuity to buy is the 2nd decision you’ll make at retirement. The first decision you’ll need to make is: “how much cash do I take“? If you missed that video, go watch it now.

I am passionate about helping people understand their behaviour with money and gently nudging them to spend less and save more. I have several academic journal publications on investor behaviour, financial literacy and personal finance, and perfectly understand the biases that influence how we manage our money. This blog is where I break down those ideas and share my thinking. I’ll try to cover relevant topics that my readers bring to my attention. Please read, share, and comment. That’s how we spread knowledge and help both ourselves and others to become in control of our financial situations.

Dr Gizelle Willows

PhD and NRF-rating in Behavioural Finance

[user_registration_form id=”8641″]

“Essentially, all models are wrong, but some are useful.” – George E.P. Box

Receive gentle nudges from us: