This post unpacks framing in behavioral finance, i.e., “it’s not what you say, it’s how you say it“. We look at some examples of narrow framing in finance and talk about the compromise effect, glossing, and the enabling frame. We need frames to make sense of the world. But they can also cause some problems which we’ll discuss as we give you some tips to overcome narrow framing.

If you’re not subscribed to our YouTube channel yet, well – why not? Click subscribe now! Or follow us on your favourite podcast platform.

Framing is a bias that’s not about the specific information that you’re presented with, but rather HOW that information is presented to you. In other words, “it’s not what you say, but how you say it”. Essentially, the framing of information changes your perception of the actual information.

Imagine that you’re walking through the shopping mall, and you see a sign for a sale in a clothing shop. On the rack of sale items, you have clothes that are 10% off all the way through to one item that is 80% off. The sign could say “between 10% and 80% off” or it could say “up to 80% off”.

Which one is more likely to make you stop and take a look?

I know I like the sounds of the second one a whole lot more. Let’s not forget that the second sign is probably styled so that the words “80% off” are big and bold, while the “up to” will be much smaller and not as noticeable.

In a previous post, we shared another example of two different wine lists, where the same bottle of wine can be listed with two cheaper bottles (it then looks expensive) or between an expensive and cheaper option (it then looks like the reasonable alternative). This is called the compromise effect – a very closely related term to the framing effect. It’s a technique that is favoured by marketers. And I’m sure you can understand why.

A key learning point is that price is not necessarily indicative of value. Share on XAnother form of framing is glossing. Think about a falling share price that is termed a ‘correction’. Or transforming problems into ‘opportunities’, and ‘weaknesses’ into ‘areas for development’. Here’s another good example – an overpaid acquisition price branded as ‘goodwill’.

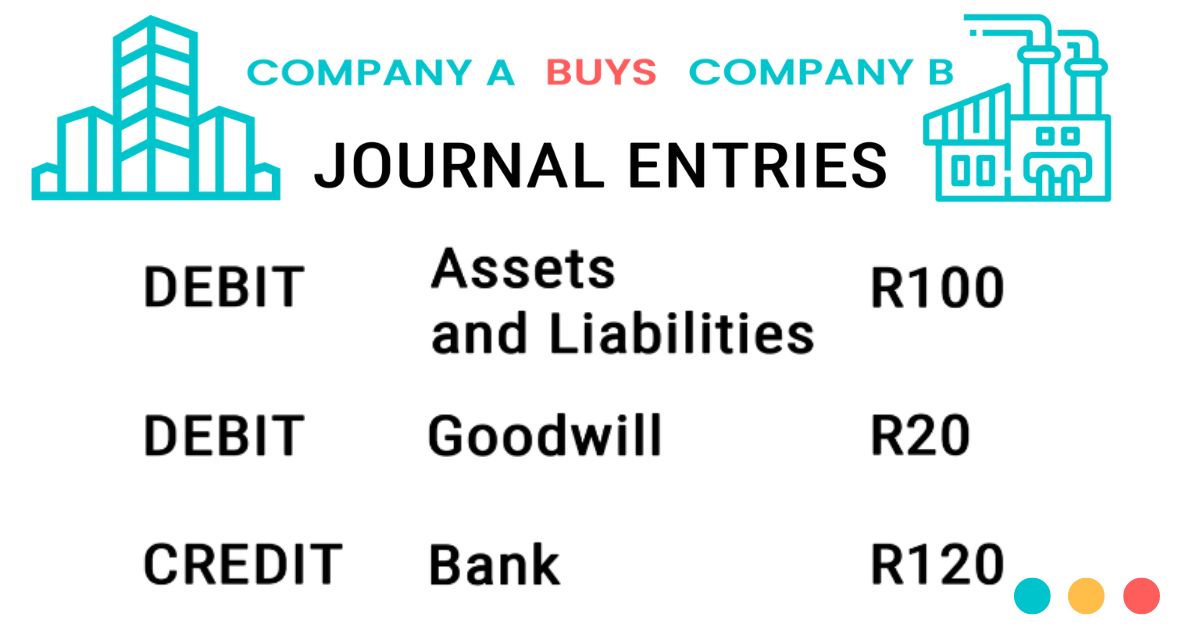

Bear with me here… When company A buys Company B, they do due diligence and determine what the fair value of all Company B’s assets is. That’s the value of all their assets, less the value of all their liabilities. Let’s say that’s R100. But Company B will only accept a price of R120. Stay with me… we need to do some elementary accounting to explain this one. And accounting is all about balancing those debits and credits.

So, when Company A buys Company B, they recognise a credit of R120 going off their bank. But every credit needs a debit… On the debit side, they recognise all the assets and liabilities they’ve taken over from Company B. But we know that comes to only R100. Oh dear! Our journal doesn’t balance. The difference, which is a debit of R20, is what Company A then calls ‘goodwill’. It’s supposed to represent the extra you paid for intangible benefits, things like access to client lists, synergies… But, other times, it’s actually just overpaying. But we call it goodwill because it frames it better.

The idea of glossing is that you frame something that is actually negative into a positive light. We all do it. If you make a mistake, you want to feel better about yourself so you put a positive spin on the situation. At your last job interview, you probably spun some of your weaker qualities with a positive light to make you look like a better hire. Or maybe you were fired from your last job, so you gloss that over with a story of how the company forced you out. It’s totally natural.

The problem is that there is a huge potential for abuse with glossing. Like a war framed as a ‘special military operation’.

We also need to talk about the size of the frames. In an interview with Daniel Kahneman, he had the following to say about narrow frames:

People tend to frame things very narrowly. They take a narrow view of decision-making. They look at the problem at hand and they deal with it as if it were the only problem. Very frequently, it’s a better idea to look at problems as they would occur throughout your life and then you look at the policy that you ought to adopt for a class of problems. Difficult to do [but] would be a better thing.

We tend to deal with each problem or question as if it existed in a bubble, on its own. Instead, we need to look at the larger context of the situation.

In the investment world, narrow framing is a term used to describe people who view each individual share or investment in isolation. This is very relevant for day traders because they work on one single trade to the next. And often it’s okay if you lose 8 trades out of 10, because the 2 you win have higher profit margins, so you win overall. The key for a good trader is to always have a wide frame when looking at the performance of ALL your trades.

We tend to deal with each problem or question as if it existed in a bubble, on its own. Instead, we need to look at the larger context of the situation.

In the investment world, narrow framing is a term used to describe people who view each individual share or investment in isolation. This is very relevant for day traders because they work on one single trade to the next. And often it’s okay if you lose 8 trades out of 10, because the 2 you win have higher profit margins, so you win overall. The key for a good trader is to always have a wide frame when looking at the performance of ALL your trades.

Another thing to consider about framing is this – when it comes to money decisions, our brains need us to form frames. A dangerous frame, however, is “I deserve this”. When you start framing your spending decisions in such a way, you can convince yourself that you should spend money on just about anything. Remember what we discussed about lifestyle creep in a previous post? With this frame, your lifestyle creep can grow exponentially.

Parents, listen up!

The enabling frame refers to how you might have a broad definition of what constitutes a necessity and, for example, you help your children with things that they could probably handle on their own. It can quite often be seen in the way parents choose to pay for things versus how their children have decided to spend their money because they have different priorities.

As an example, your child gets an allowance from you for doing various chores around the house. And it’s a good allowance, enough at least for them to buy the essential clothing items that they need each season. But winter comes and they’ve spent all their money on games. Now… their winter clothes are looking worn and their jackets are too small. What do you do as a parent? You go out and get them some warm winter clothes of course, because, you can’t have your child getting cold. You change the story to fit your actions.

Now parents, this is normal. And we can argue whether the child intentionally spent all their money on games, knowing that mom and dad would buy them clothes, or whether it was just a lack of foresight. The age of the child is probably also relevant here. But take this example and apply it to things where you now maybe recognise you might be enabling others. You’re just creating a different frame to suit the story you’re telling yourself.

We had a chat with Louis van der Merwe, Certified Financial Planner at Wealth Up, and host of Ensombl Advice South Africa – a podcast which is dedicated to driving the positive evolution of financial advice. If you’re in the financial planning profession, it’s well worth a listen.

We asked Louis if he is able to pick up or spot this narrow framing bias with his clients, before they make a potentially bad decision? Here’s what he said:

I think it goes back to “what are the core skills of a financial planner”? And one that is so difficult to cultivate is actually listening for what someone is not saying. It’s slowing down the conversation and picking up that, hold on, this client keeps on coming back to this specific area and mapping out in your mind what other alternatives there could be. And then hopefully framing the questions more open-ended to say, “oh, you know, we’ve considered that, but what else might we consider? You know, are there other options for us here? Is this the only option?” Really big open-ended things where you might not feel like the expert, but you challenge your client to say, okay, let me change my thought pattern in this specific thing that I’m so passionate and I’ve already made up my mind to maybe consider alternatives.

We asked if he ever gets stuck with a client who is just so narrow in their thinking and incredibly difficult to move and widen that frame? If he ever has those situations, and if so, what is the best way to approach that with a client?

I think as humans, we get stuck in our emotions. If we look at what drives our decision-making, unfortunately, it’s not the technical things, it’s not the clear answers, it’s typically the emotions underlying that decision. [We need] to slow down, to notice what’s coming up, what might be driving these decisions, and getting them to see that insight.

I find that makes the conversation easier because we’re 6 times more likely to follow our own thought patterns than what someone else tells us. And if we get to a point where we can say, you know what, I’m actually holding onto this thing out of fear or I’m buying this out of greed or there’s just this really irrational thing that has happened. If we slow down, it changes the conversation, and we can automatically look at other options.

This really emphasises how important it is that you have a relationship with your financial planner. Because the only way you can have these conversations – these constructive conversations – is if you have a really good relationship with them, where you trust them.

If you’re willing to pick up the phone and say, hey, I’m thinking about this decision. Can you give some insight? Can you help me here? It’s getting to a point where you acknowledge that maybe there’s something at stake here. I want to bring in someone else’s opinion and it might be a financial advisor. It might be your spouse. It might be your best friend. As long as that person has some sense of trying to challenge what it is that you’re trying to achieve, some insight from what works. The benefit of talking to a financial planning is that we see the scenarios over and over again, right? So, you get a little bit more trained at knowing what to spot. But anyone could essentially help you to reframe a conversation because it’s ultimately about decisions. Am I going to do something? Or am I going to do nothing? Which is also an active decision.

We hope you can see that everything that is communicated to you contains an element of framing. Think of your different responses when something is framed as a loss rather than a gain. That’s when prospect theory and risk aversion come knocking. But the thing is… framing isn’t always done intentionally. And even when it is done intentionally, it’s not necessarily malicious – it might just be there to provide context.

As you can see, all these biases that we’ve been talking about are such a big part of everyday life that it becomes difficult to spot them and to know if they are impacting your decision making in a negative way. We’re going to keep saying it though – being aware of these biases will help you to spot them and interrogate them. Be a scholar first. That’s the only way to combat them.

Want to pin this post for later?

[apsp_save_button type=’one-image’ shape=’rectangle’ size=’large’ save_url=’www.nudgingfinancialbehaviour.com/narrow-framing/’ save_image=’https://www.nudgingfinancialbehaviour.com/wp-content/uploads/2023/07/the-framing-effect.jpg’ image_description=’Narrow framing, the compromise effect, glossing, and the enabling frame. We need frames to make sense of the world. But they cause problems.’]

The anchored trader – Anchors tie us down and can have serious consequences for investors and traders. Don’t be the anchored trader.

Let us know in the comments below.

[apsp-follow-button name=’nudgingfinancialbehaviour’ button_label=’Follow on Pinterest’]

Let us know in the comments below.

[apsp-follow-button name=’nudgingfinancialbehaviour’ button_label=’Follow on Pinterest’]

I am passionate about helping people understand their behaviour with money and gently nudging them to spend less and save more. I have several academic journal publications on investor behaviour, financial literacy and personal finance, and perfectly understand the biases that influence how we manage our money. This blog is where I break down those ideas and share my thinking. I’ll try to cover relevant topics that my readers bring to my attention. Please read, share, and comment. That’s how we spread knowledge and help both ourselves and others to become in control of our financial situations.

Dr Gizelle Willows

PhD and NRF-rating in Behavioural Finance

Receive gentle nudges from us:

[user_registration_form id=”8641″]

“Essentially, all models are wrong, but some are useful.” – George E.P. Box