We are already aware that behavioural biases are unintentionally responsible for many of our poor financial and consumer decision making. Thus, wouldn’t it be nice if we could get some helpful suggestions rather than just being told what we do wrong the whole time? Fortunately, we can. That’s where libertarian paternalism and default options can help us. But, given the law of unintended consequences, such status quo bias comes with its own set of problems.

We’ll be covering the following:

Libertarian paternalism is the idea that it is both possible and legitimate for institutions to affect behaviour while still respecting freedom of choice. It’s one of the core concepts from Cass Sunstein and Richard Thaler’s book: Nudge: Improving Decisions about Health, Wealth, and Happiness.

The social psychology principle maintains that an institution can set a default option that is meant to be the best option for most individuals. However, there must always be an option to opt out. Thus, while behavioural agents are automatically enrolled into the default option, rational agents are free to opt out. This is particularly helpful for those individuals with self-control issues or in even simpler instances, where the consumer doesn’t have a preference nor understands the difference in the system options presented. And if we set auto-renewals for the existing state, this then continues in perpetuity. This is helpful if we understand the degree and nature of consumer biases.

By setting a default, we can force active choice by the user. But, one-size seldom fits all. Share on X

A good example of the power of defaults pertains to organ donation. Different countries have different default options for the decision to become an organ donor. Some countries require explicit consent and opting-in to become a donor, while others presume consent and require opting-out for those who do not want to be donors.

In Austria, more than 90% of people are registered to donate their organs. Austria is an opt-out country. Yet, in Germany (a culturally similar country), fewer than 15% are registered. Germany is an opt-in country.

Psychologists have attempted to understand these differences and explain that organ donation in opt-in countries is viewed as a form of philanthropy – like leaving 60% of your estate to charity. However, in opt-out countries, deciding not to donate your organs is like choosing to miss your child’s graduation ceremony!

A good example of the power of defaults pertains to organ donation. Different countries have different default options for the decision to become an organ donor. Some countries require explicit consent and opting-in to become a donor, while others presume consent and require opting-out for those who do not want to be donors.

In Austria, more than 90% of people are registered to donate their organs. Austria is an opt-out country. Yet, in Germany (a culturally similar country), fewer than 15% are registered. Germany is an opt-in country.

Psychologists have attempted to understand these differences and explain that organ donation in opt-in countries is viewed as a form of philanthropy – like leaving 60% of your estate to charity. However, in opt-out countries, deciding not to donate your organs is like choosing to miss your child’s graduation ceremony!

It’s not surprising that governments and institutions want us to save for our retirement. And the argument is that if people won’t voluntarily do what is in their best interest, then we should nudge them. But, it’s a sensitive topic when you ask someone to take a pay-cut so that they can save more.

This is where a very popular programme called Save More Tomorrow™ was developed by Richard Thaler and Schlomo Benartzi. The design is simple: if you enrol with the programme you agree that when you receive salary increases, the amount you contribute to retirement savings will also increase incrementally.

Starting point

Salary: $1000

Retirement contribution: 10% = $100

Take-home pay: $900 ($1000 – $100)

After first pay increase

Salary: $1080

Retirement contribution increased to 12% = $130

Take-home pay: $950 ($1080 – $130)

From a behavioural perspective, the win with this programme is that you don’t ever feel like you’re sacrificing your take-home pay to save for the future. You were getting $900 out, you now get $950. Your increases are just smaller. But, because you’re incrementally increasing the percentage you save for retirement (12%, not 10%) the cumulative growth on your savings surpasses anything you’d save if you just stayed at the same percentage. It might sound like small changes, but the impact is really astonishing.

Let’s pause for a moment and consider all the behavioural biases that a programme like this addresses. First, there’s loss aversion, in that we don’t want to see our take home pay being reduced, which doesn’t happen here. Second, there’s our lack of self-control and procrastination. Naturally, we prefer immediate certain rewards over uncertain longer-term ones. This is the biggest struggle with motivating retirement savings as it’s so far in the future (for some of us) and who knows if we’ll even live that long (uncertainty)? Third, there’s inertia, in that we just let the status quo bias take over. Thus, by setting a scheme like this as the default, we’re not really bothered to opt-out.

Let’s pause for a moment and consider all the behavioural biases that a programme like this addresses. First, there’s loss aversion, in that we don’t want to see our take home pay being reduced, which doesn’t happen here. Second, there’s our lack of self-control and procrastination. Naturally, we prefer immediate certain rewards over uncertain longer-term ones. This is the biggest struggle with motivating retirement savings as it’s so far in the future (for some of us) and who knows if we’ll even live that long (uncertainty)? Third, there’s inertia, in that we just let the status quo bias take over. Thus, by setting a scheme like this as the default, we’re not really bothered to opt-out.

Increasingly, investment houses and company pension funds will have default options. It would be perilous to entrust people with managing their own savings. We don’t behave as the models predict. In fact, we don’t even behave the way we think we will. And so, default investing options have been designed to overcome some of these behavioural effects.

An example of this is the ‘life-cycle’ product. It’s the idea that as you get closer to retirement age, your retirement savings will move from higher-risk investments (equity) to lower-risk investments (cash). This might start at age 60, where 20% sits in low risk and 80% in med-high risk. By the time you’re 65 years of age, your entire investment is in cash. In theory, this appears to be sensible, but it ignores other moving parts, such as your longevity or how liquid the balance of your portfolio might be looking. These spillover effects have been well-researched.

…for pure investors electing lifestyle funds on a voluntary basis, adopting the lifestyle offerings boosts equity exposure with age, eliminates extreme asset allocations, enhances portfolio efficiency, and reduces nonsystematic risk exposure

…for pure investors electing lifestyle funds on a voluntary basis, adopting the lifestyle offerings boosts equity exposure with age, eliminates extreme asset allocations, enhances portfolio efficiency, and reduces nonsystematic risk exposure

The philosopher Isaiah Berlin has written and spoken on the topic of two concepts of freedom i.e. positive and negative freedom. The difference is freedom from restraint and freedom that comes from self-mastery or self-realisation. With positive freedom you can do whatever you want, provided you don’t hurt anyone else. But negative freedom is where we are coerced to act in our own best interests i.e. defaults.

Libertarian paternalism might seem like an oxymoron but it is the idea that it is both possible and legitimate for private and public institutions to affect behaviour while also respecting freedom of choice. However, we must remember to maintain moral justification when nudging people to make better decisions by using their behavioural weaknesses against them.

The philosopher Isaiah Berlin has written and spoken on the topic of two concepts of freedom i.e. positive and negative freedom. The difference is freedom from restraint and freedom that comes from self-mastery or self-realisation. With positive freedom you can do whatever you want, provided you don’t hurt anyone else. But negative freedom is where we are coerced to act in our own best interests i.e. defaults.

Libertarian paternalism might seem like an oxymoron but it is the idea that it is both possible and legitimate for private and public institutions to affect behaviour while also respecting freedom of choice. However, we must remember to maintain moral justification when nudging people to make better decisions by using their behavioural weaknesses against them.

Be careful what you wish for though. Considering the definition of negative freedom, such strongarming might appear simple to begin with, but it could create much larger problems in the future.

You might recall with prospect theory that our risk-averse and risk-seeking behaviours are centred to a reference point or status quo, and that this reference point is subjective and can be different for different people or different scenarios? This is where anchors come into play.

Anchors of ships are put into the ocean, to ensure they don’t stray too far away from a certain point. We do the same with our reference points. Share on XConsider your options when downloading new applications on your mobile device or computer. Often, there are many customisable options in the settings, but we ignore that and just go with the default option. New cars are often advertised in a certain colour. In every advertisement and catalogue you’ll see the car in that same colour. Even though you can buy the car in a variety of colours, most buyers select that default colour.

Even when no options are given, the default option is at work. This is because we make our past the default setting, thus extending and enabling the status quo. Our human brain likes what it knows. If given the choice of trying something new or sticking to the tried and tested option, we tend to be highly conservative even if a change would be beneficial (links a bit with the endowment effect). Like eating out at your favourite restaurant and ordering the same meal every time, despite a new meal on the menu which everyone is raving about. We don’t like the mere exposure to such cognitive strain and allow status quo bias to prevail.

While pure convenience does play a part, status quo bias primarily arises because of our loss aversion. Remember that losses upset us more than gains please us. Thus, renegotiating contracts or trying a new dish at a restaurant, while it might bring you extra value or pleasure, it’s not worth the risk of losing your current enjoyment. Put simply, concessions that you make weigh heavier than any you receive, so such exchanges end up feeling like net losses.

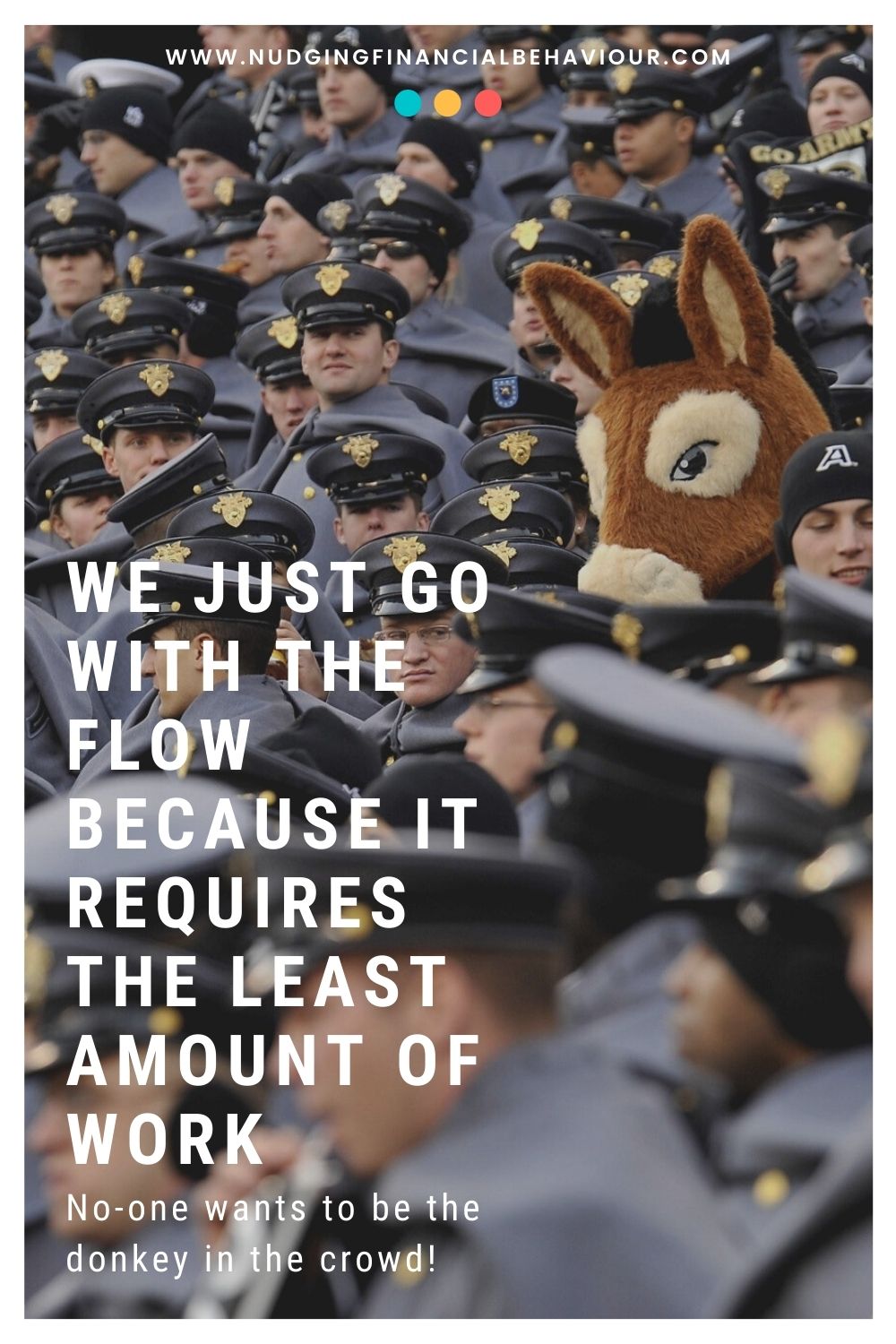

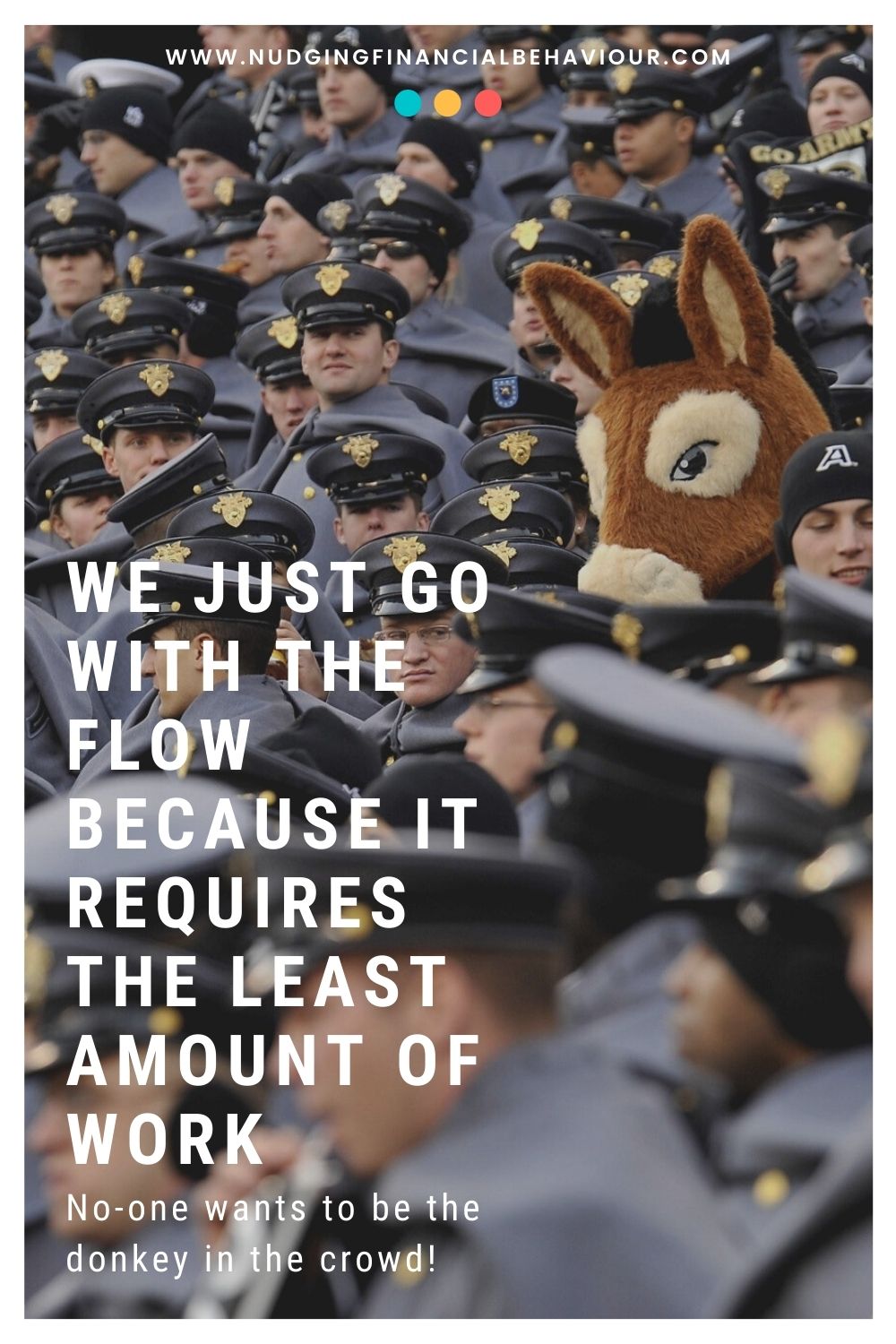

The status quo is also often set as whatever the group or majority are doing. So we just go with the flow and make decisions (or don’t make decisions) because it requires the least amount of work. We remain in whatever the current state is. At least, that’s what the data and research shows.

While pure convenience does play a part, status quo bias primarily arises because of our loss aversion. Remember that losses upset us more than gains please us. Thus, renegotiating contracts or trying a new dish at a restaurant, while it might bring you extra value or pleasure, it’s not worth the risk of losing your current enjoyment. Put simply, concessions that you make weigh heavier than any you receive, so such exchanges end up feeling like net losses.

The status quo is also often set as whatever the group or majority are doing. So we just go with the flow and make decisions (or don’t make decisions) because it requires the least amount of work. We remain in whatever the current state is. At least, that’s what the data and research shows.

Don’t let anything stand in the way of you claiming and manifesting the life that you choose rather than the life you have by default.

We know that defaults work and we know why they work. But while we’re nudging people in one direction to get a desired outcome, there are unintended consequences. Consider the programme to increase retirement savings – this will result in less consumer spending to fuel the economy.

Consider your personal situation when you get an increase – don’t default to increasing your standard of living every time. Don’t automatically spend. Try tweaking that savings rate up!

When you place an order on Amazon or Takealot, should the default be express shipping or standard shipping? What is the current default on your account? Should you edit that? Should the company stop you from proceeding to payment until you’ve made an active choice, or is it okay that they make the choice for you i.e. the default? These are all the little things we need to consider with defaults. As consumers, check the steps before you click ‘next’.

This is why we often get enrolled into unnecessary marketing campaigns. How our email addresses and mobile numbers are pawned off. It’s an opt-out system. You’re automatically agreeing to these things as they’re the default.

Lastly, perhaps check what the default option is regarding organ donation in your country, and whether you’re comfortable with that?

Want to pin this post for later?

[apsp_save_button type=’one-image’ shape=’rectangle’ size=’large’ save_url=’https://nudgingfinancialbehaviour.com/default-options-and-status-quo-bias/’ save_image=’https://nudgingfinancialbehaviour.com/wp-content/uploads/2021/03/The-danger-of-the-default.jpg’ image_description=’Default options nudge us to make better decisions. The option of opting out also respects freedom of choice. This post unpacks this notion of libertarian paternalism and the perils of status quo bias.’]

Let us know in the comments below (or go with the default option, and leave no comment).

Let us know in the comments below (or go with the default option, and leave no comment).

[apsp-follow-button name=’nudgingfinancialbehaviour’ button_label=’Follow on Pinterest’]

I am passionate about helping people understand their behaviour with money and gently nudging them to spend less and save more. I have several academic journal publications on investor behaviour, financial literacy and personal finance, and perfectly understand the biases that influence how we manage our money. This blog is where I break down those ideas and share my thinking. I’ll try to cover relevant topics that my readers bring to my attention. Please read, share, and comment. That’s how we spread knowledge and help both ourselves and others to become in control of our financial situations.

Dr Gizelle Willows

PhD and NRF-rating in Behavioural Finance

Receive gentle nudges from us:

[user_registration_form id=”8641″]

“Essentially, all models are wrong, but some are useful.” – George E.P. Box

This is a good tip especially to those fresh to the blogosphere.

Short but very precise information… Many thanks for sharing this one.

A must read post!