In the vast realm of financial decision-making, biases often play a significant role in shaping our choices. One such bias, known as home bias , can have a profound impact on our investment decisions, potentially leading to missed opportunities and suboptimal outcomes.

In this blog post, we’ll delve into what home bias is, explore how it influences our financial choices, provide practical examples of its effects in everyday life and in your investment decisions, and offer strategies to overcome it. So, let’s embark on this journey to understand and conquer home bias.

Home bias is a psychological bias that occurs when individuals exhibit a preference for familiar or domestic assets over foreign ones when making financial decisions. In simpler terms, it’s the inclination to invest more heavily in assets from one’s own country or region, even when diversifying across international opportunities could be more advantageous.

Home bias stems from familiarity bias or availability bias in behavioural finance. Recall that availability bias is a mental shortcut we take where we overweight the relevance of reading available information. It’s what advertisers use all the time. Keep putting a certain product in front of you… and repeat – it makes you remember and it makes you more susceptible to buying it.

Allowing our decisions to be influenced by stereotypes and what information is available to us helps create our home bias. This bias can manifest in various forms, such as favouring domestic stocks, bonds, or real estate investments.

We invest in what we know. Share on XIt does make sense that you’d be more comfortable with what you’re familiar with (it’s perhaps the illusion of control sneaking in). Because a company sells a product that you like to use, you believe that company might be a good one to invest in. And because you live in your country, you believe it’s a good one to invest in and you add it to your equity portfolio.

While it’s natural to feel a sense of comfort and familiarity with local investments, this home or local bias can hinder wealth accumulation and limit financial diversification. Furthermore, investing in only one country presents significant political and market risks.

Home bias exerts a significant influence on our financial choices, both overtly and subtly. One of the most noticeable effects is the reduction in diversification. Investors tend to concentrate their assets heavily in their domestic market, which can lead to heightened portfolio risk and missed opportunities for growth. This lack of diversification might result in missed opportunities in sectors or industries that perform better in foreign markets. For instance, although tech giants like Apple and Amazon hail from the United States, innovative tech companies thrive worldwide.

Cultural and emotional attachments also often make individuals hesitant to explore foreign investments, be it due to concerns about political stability, currency risk, or simply a sense of patriotism. This avoidance of international opportunities can expose investors to unnecessary currency risk as well as potential losses if their domestic currency weakens compared to foreign ones.

“The four most dangerous words in investing are: ‘This time it’s different.'” – Sir John Templeton

Some specific examples of how this home bias puzzle might be influencing your investment decisions:

Some specific examples of how this home bias puzzle might be influencing your investment decisions:

If it makes you feel any better, even fund managers display equity home bias. As we know, fund managers love charts and technical indicators.

The stock market is filled with individuals who know the price of everything but the value of nothing.

The media plays into all this which exacerbates our home bias. What we mean by this is that the medica coverage of companies (the things we then hear) is correlated to the geographical distribution of shareholders.

Research has shown that local media reports of businesses have an impact on purchases and sales of shares in that business. Two notable points are that the media reports have to be relevant to the investors and, unsurprisingly, negative reporting has a stronger effect than positive reporting.

As an example, local papers will preferentially report on stories about local companies. This reporting then drives the share price of the company. This would only happen if local investors are heavily invested. Which shows that they’re investing in familiar companies at home.

We invest in the familiar and forget the principles of portfolio theory. Share on XThe side-effect of investing in well-known companies is that it’s generally the successful companies that are well-known. So, you’re putting yourself on the wrong side of mean reversion. By the time the company is successful, you’ve already missed the largest part of its growth. Now, I’m not saying go take a gamble on unknown companies. You still need to do your research!

A particularly bad case of home bias is when you’re over invested in your employer. To start, if you’re drawing a salary, you’re already exposed to the company. If you’re sitting with stock options or any similar share-based scheme, again, direct investment in the company’s performance (or non-performance).

Just because you work for someone doesn’t mean you understand the business. In fact, more often than not you’ll have confirmation bias. If you’re in a situation where your salary, your pension and your investment portfolio are all dependent on one company is not wise at all!! Need I remind everyone what happened to the employees of Enron and Worldcom? More recently, staff of Silicone Valley Bank who received part of their salaries in company equity, lost millions.

It’s one thing to lose your job. Another to also lose your life savings.

One thing that the crash of 2008 taught us was that if you’re investing internationally, it doesn’t make much difference to your returns, as pretty much everything, everywhere, fell at the same time. But research helps us again. These researchers show that taking a long-term view and avoiding home bias can protect you.

“Even though market panics can be important drivers of short-term returns, country-specific economic performance dominates over the long term. Diversification protects investors against the adverse effects of holding concentrated positions in countries with poor long-term economic performance. Let us not fail to appreciate the benefits of this protection.”

So while global crises happen, there are many more that are localised to specific regions. International diversification is essential. And nowadays, with one ETF that can give you broad spectrum exposure to a piece of the entire world, there’s really no excuse.

Overcoming home bias is crucial to optimizing your financial portfolio. Here are some strategies to help you mitigate this bias:

Education and Awareness: The first step in overcoming home bias is to recognize its presence. Educate yourself about the advantages of diversification and the risks associated with an overly concentrated portfolio.

Set Diversification Goals: Establish clear goals for diversifying your portfolio across different asset classes and geographical regions. Consider working with a financial advisor to create a well-balanced investment strategy.

Use Global Indices: Invest in exchange-traded funds (ETFs) or unit trusts that track global indices. These funds provide exposure to a wide range of international assets, making diversification easier.

Regular Portfolio Rebalancing: Periodically review and rebalance your portfolio to ensure it aligns with your diversification goals. Sell off over-concentrated domestic assets and reinvest in underrepresented foreign ones if that makes financial sense. Don’t incur transaction costs unnecessarily.

Seek Professional Guidance: Consult with a financial advisor who specializes in international investments. They can provide insights into global markets and help tailor a diversified strategy to your needs.

When considering your overall portfolio of investments, it is important to have investments that earn their return in your home country. You earn your income in that country and you pay for things in that country. However, your overall portfolio should be more ambitious.

For those living in developed countries, consider if you have sufficient emerging markets in your portfolio to take advantage of greater returns that can be earned when coming off a lower base. For those that live in an emerging market, go and work out what percentage of the global investment market your country contributes towards, and use that number as an anchor. For my fellow South Africans, that answer is around 0.7%.

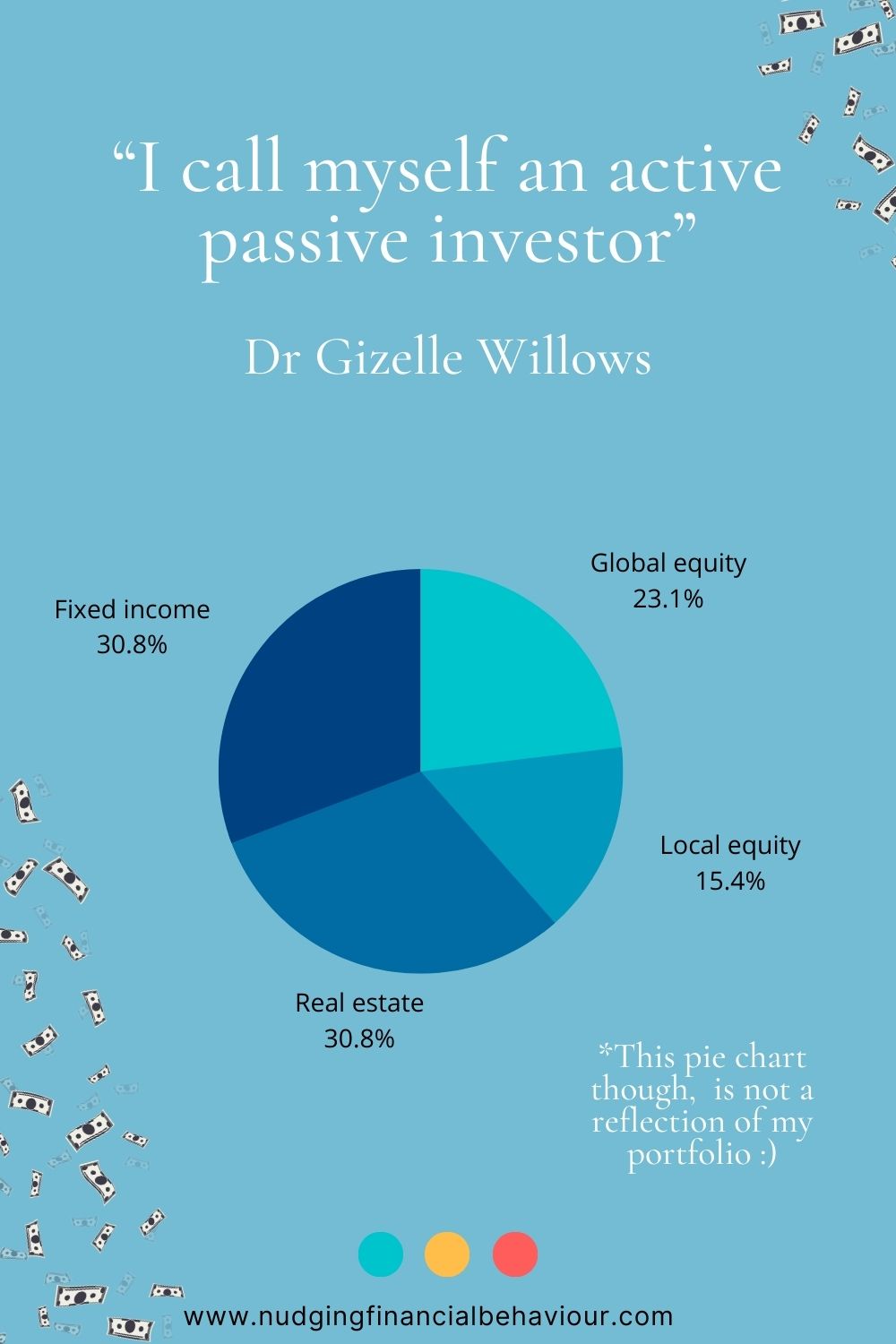

I call myself an active passive investor. While I like the concept of “one ETF to rule them all”, I have my money in various pots (some by choice, others are legacy issues). Nonetheless, I need to work with what I’ve got and at a minimum, I like to ensure that I’m diversified in a way that serves me.

A problem with having several underlying investments is that many ETFs track the same things, so you end of double-dipping. So I like to ensure that I know the underlying exposure of each fund and that collectively, I’m well-diversified.

I can’t take full credit for this. I watched a webinar a few years back where Nerina Visser shared this concept of being an active passive investor. So I’m merely building on that.

There is a spreadsheet (obviously). And – spoiler alert – I have already secured Nerina to come chat to us about this in Season 2 of the podcast. So there’s something to look forward to…

Home bias is a psychological bias that can have a significant impact on our financial decision-making, potentially limiting our returns and increasing risk. By understanding the nature of this bias, recognizing its effects in everyday life and investment choices, and implementing strategies to overcome it, we can take more informed and balanced steps towards building a resilient and diversified financial portfolio.

In the realm of investing, it’s crucial to remember Warren Buffet’s wise words: Diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing.

Embrace the global marketplace, diversify your investments, and break free from the confines of home bias to achieve your financial goals.

Want to pin this post for later?

[apsp_save_button type=’one-image’ shape=’rectangle’ size=’large’ save_url=’www.nudgingfinancialbehaviour.com/home-bias’ save_image=’https://www.nudgingfinancialbehaviour.com/wp-content/uploads/2023/09/understanding-and-overcoming-home-bias.jpg=’We invest close to home and in what we know. But this lack of diversification results in missed opportunities. Say hello to ‘home bias’.’]

Let us know in the comments below.

[apsp-follow-button name=’nudgingfinancialbehaviour’ button_label=’Follow on Pinterest’]

I am passionate about helping people understand their behaviour with money and gently nudging them to spend less and save more. I have several academic journal publications on investor behaviour, financial literacy and personal finance, and perfectly understand the biases that influence how we manage our money. This blog is where I break down those ideas and share my thinking. I’ll try to cover relevant topics that my readers bring to my attention. Please read, share, and comment. That’s how we spread knowledge and help both ourselves and others to become in control of our financial situations.

Dr Gizelle Willows

PhD and NRF-rating in Behavioural Finance

Receive gentle nudges from us:

[user_registration_form id=”8641″]

“Essentially, all models are wrong, but some are useful.” – George E.P. Box