Our lack of self-control is akin to procrastination which refers to our tendency to delay unpleasant but important acts. Completing your tax return, switching to a cheaper insurance policy, having that uncomfortable conversation. We’ve all heard that procrastination is the enemy of success, but why is procrastination bad? Why is it the enemy of time?

While procrastination looks like laziness, it is often just mental exhaustion at play. I never thought I’d defend procrastination, but here it goes….

An experiment put two groups of students in front of some freshly baked chocolate cookies and a bowl of radishes. The one group was told they could eat as many cookies as they want. The other group were told they could eat as many radishes as they want (but were not allowed any cookies). The researchers left the room to induce temptation, but the radish group were strong and able to resist the cookies.

Moving onto part 2 of the study, both groups were asked to complete a complex logic puzzle. Unbeknownst to the students, the test was designed to be impossible. The researchers simply wanted to see how long the students would persist with the difficult task.

The students who were forbidden to eat any cookies gave up on the puzzle twice as fast as those who could devour freely on cookies. The self-control required to resist the cookies had drained their mental energy, which was now required to solve the puzzle.

Willpower is like a battery, at least in the short term. If it is depleted, future challenges will falter. This is a fundamental insight. Self-control is not available around the clock. It needs time to refuel.

In the broad sense of the term, self-control is exhaustible. This explains why when we come home after a long and exhausting day at work, we’re more likely to snap at our partner or eat more than we should.

We also burn a lot of our self-control in change situations. This is where we substitute new unfamiliar behaviours with behaviours that are older and more comfortable.

An experiment put two groups of students in front of some freshly baked chocolate cookies and a bowl of radishes. The one group was told they could eat as many cookies as they want. The other group were told they could eat as many radishes as they want (but were not allowed any cookies). The researchers left the room to induce temptation, but the radish group were strong and able to resist the cookies.

Moving onto part 2 of the study, both groups were asked to complete a complex logic puzzle. Unbeknownst to the students, the test was designed to be impossible. The researchers simply wanted to see how long the students would persist with the difficult task.

The students who were forbidden to eat any cookies gave up on the puzzle twice as fast as those who could devour freely on cookies. The self-control required to resist the cookies had drained their mental energy, which was now required to solve the puzzle.

In the broad sense of the term, self-control is exhaustible. This explains why when we come home after a long and exhausting day at work, we’re more likely to snap at our partner or eat more than we should.

Willpower is like a battery, at least in the short term. If it is depleted, future challenges will falter. This is a fundamental insight. Self-control is not available around the clock. It needs time to refuel.

We also burn a lot of our self-control in change situations. This is where we substitute new unfamiliar behaviours with behaviours that are older and more comfortable.

Think about your morning routine, you have a certain way of showering and brushing your teeth. You’ve been doing it for so long that it’s unconscious and effortless. What if you decided to redesign the whole thing from top to bottom? You could do it. But it would take tremendous self-control and concentration. You’d have to monitor yourself every second of that morning and by the time you start working, you’d be mentally exhausted. Change simply wears us out. Even well-intentioned people will run out of self-control after a while.

What looks like laziness, is often merely exhaustion. Share on XThis reemphasises why default options are so important. In a frictionless or non-behavioural world, default options would be irrelevant. But that’s not the world we live in. The awareness of our struggle with self-control and procrastination highlights the importance of appropriate default options. We need to start getting things right.

Think about your morning routine, you have a certain way of showering and brushing your teeth. You’ve been doing it for so long that it’s unconscious and effortless. What if you decided to redesign the whole thing from top to bottom? You could do it. But it would take tremendous self-control and concentration. You’d have to monitor yourself every second of that morning and by the time you start working, you’d be mentally exhausted. Change simply wears us out. Even well-intentioned people will run out of self-control after a while.

What looks like laziness, is often merely exhaustion. Share on X

This reemphasises why default options are so important. In a frictionless or non-behavioural world, default options would be irrelevant. But that’s not the world we live in. The awareness of our struggle with self-control and procrastination highlights the importance of appropriate default options. We need to start getting things right.

You probably already know that Barack Obama and Mark Zuckerberg wear the same thing every day. By having a routine and dressing the same each day, you save time making decisions. This means you’ll have more mental energy to focus on advantageous opportunities and personal growth.

You need to focus your decision-making energy

Making decisions is exhausting. It’s been termed decision fatigue for a reason. Therefore, people in jobs which require a lot of decision making need to take a lunch break! It doesn’t matter how busy you are, that break, where you relax and eat something, is essential to recharge your mental strength.

You need to focus your decision-making energy

Making decisions is exhausting. It’s been termed decision fatigue for a reason. Therefore, people in jobs which require a lot of decision making need to take a lunch break! It doesn’t matter how busy you are, that break, where you relax and eat something, is essential to recharge your mental strength.

A famous example of decision fatigue comes from a study that examined the decisions made by parole boards at Israeli prisons. The researchers found that judges were more likely to issue favourable decisions to prisoners seeking parole if the cases were heard early in the day. The prospect of a favourable judgement declined as the morning progressed but improved after a break for rest and food. The easy option, which is keeping the prisoners in jail, is sticking to the status quo.

Procrastination and success. There's a reason these two terms aren't well-aligned. Share on XThe consequences of decision fatigue are partly explained by going back to the start, System 1 and System 2. As a recap, System 1 (fast thinking) is our intuition while System 2 (slow thinking) is deliberate. System 2 is better for complex situations that require careful consideration. However, we’re not the best at recognising such situations and thus often misapply System 1. Resource depletion (i.e. decision fatigue) enhances the role of System 1 by limiting the deliberate overriding role of System 2.

Choice deferral is merely a sly way of referring to procrastination – and resource depletion (or decision fatigue) makes us more susceptible to avoiding making a decision.

When you defer making a decision, you’re allowing circumstances to make the decision for you. Share on XBy design, saving for your retirement is difficult to accept. It’s choosing something boring that won’t pay off for decades, over something that can bring immediate gratification. And there’s always the argument that you might not live to see your retirement, so rather spend your money when you’re alive. I get it. But the reality of increasing longevity means you cannot afford putting off saving for your retirement for one day longer.

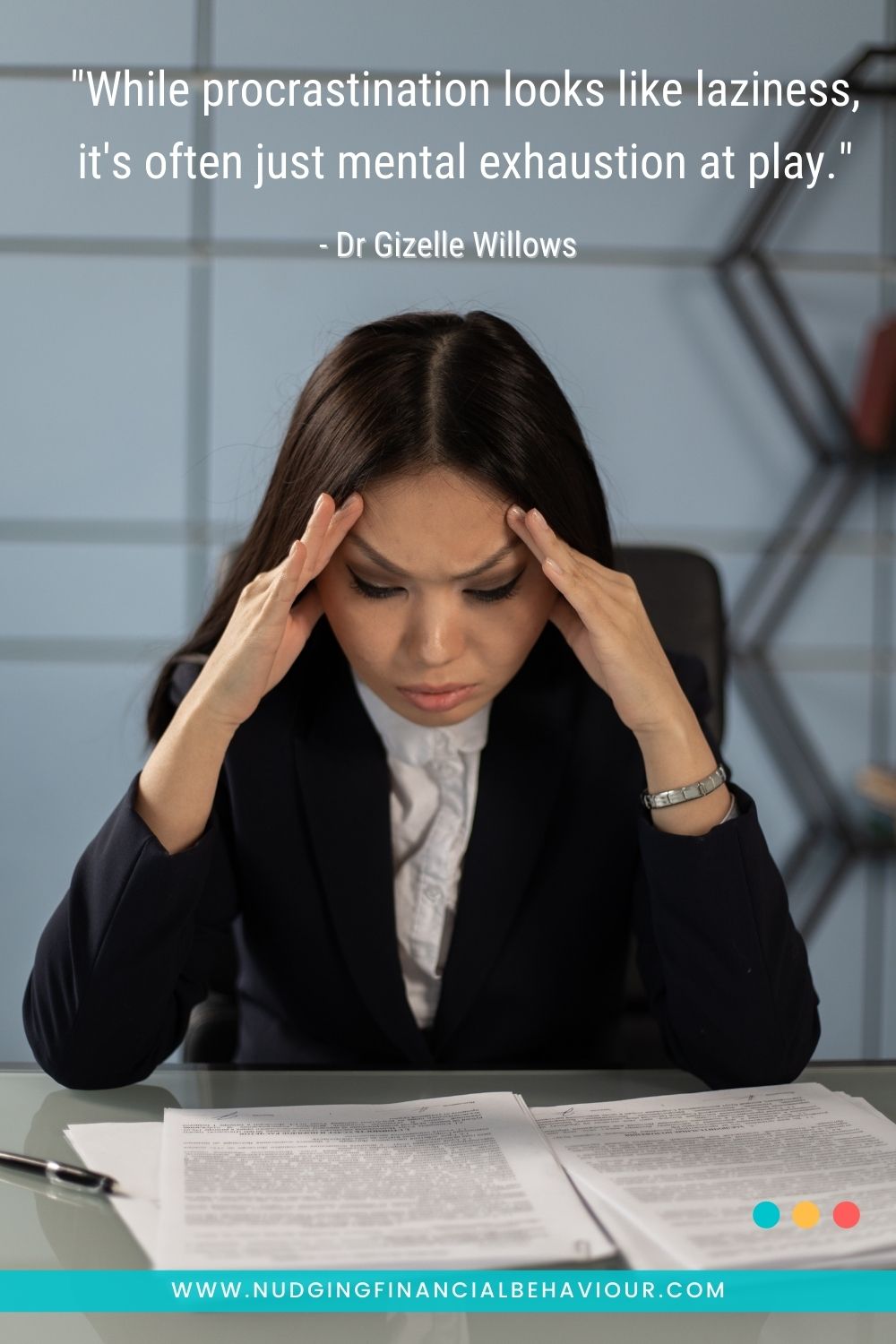

Whenever we decide to do something, we’re deciding to not do something else (opportunity cost). Thus, we need to decide which tasks to devote our time to and which to simply skim over. Let’s use the Eisenhower decision matrix to help us:

Hopefully I’ve convinced you that saving for your retirement is urgent. Never forget compound interest! The next step is for you decide whether you think it’s important or not. If you do, then great, go do it now. If you don’t, I can live with that. Get a financial planner to do it for you. In many cases, getting a financial planner is a preferable option anyway. This is not a pleasurable task. You’ll find many reasons not to do it. And most of us lack the understanding of all the parts (i.e. tax efficiency, estate planning, diversification, fees, to name a few) to do it in the most optimal and efficient manner.

I’m happy for you to forego reading this post to the end if you rather want to take the time to make an appointment (a Certified Financial Planner (CFP) please, check their accreditation).

Action will destroy procrastination.

As are most things in behavioural finance, procrastinating is most problematic for those that don’t understand its impact.

We’re more likely to procrastinate with big important tasks than minor less-important ones. So, you might have full intention to sort out your retirement savings but then as soon as you’re presented with too many options, you feel overwhelmed (information overload), and don’t complete the task. We naively place the task in the “too difficult” box and never get round to dealing with it. The fear of getting it wrong means we end up doing nothing.

Procrastination is the enemy of success. Time to overcome procrastination and achieve success! Share on X

Researchers have shown that three factors interrelate to determine whether procrastination will happen – the lack of self-control, the lack of domain knowledge, and the range of possible options. Thus, even if you have commendable self-control and great knowledge, you’ll start to hesitate when presented with too many options.

As are most things in behavioural finance, procrastinating is most problematic for those that don’t understand its impact.

We’re more likely to procrastinate with big important tasks than minor less-important ones. So, you might have full intention to sort out your retirement savings but then as soon as you’re presented with too many options, you feel overwhelmed (information overload), and don’t complete the task. We naively place the task in the “too difficult” box and never get round to dealing with it. The fear of getting it wrong means we end up doing nothing.

Procrastination is the enemy of success. Time to overcome procrastination and achieve success! Share on XResearchers have shown that three factors interrelate to determine whether procrastination will happen – the lack of self-control, the lack of domain knowledge, and the range of possible options. Thus, even if you have commendable self-control and great knowledge, you’ll start to hesitate when presented with too many options.

To manage your limited willpower, you need to create a routine for yourself. Free up your mental energy so you have more available for when you really need it. Find out what recharges you. For me, that’s exercising and getting enough sleep.

Eliminate distractions. For me, again, that means switching off the wifi when I need to work on a challenging piece of writing. And deleting subscriptions to any advertising emails (If I’ve used up all my willpower and see that advertising email come, I’ll be less susceptible to resisting it.)

We need to remove temptation and not give our impulses any power. Don’t keep the food you’re trying to avoid eating in the house.

Another effective approach is to set deadlines. But self-imposed deadlines will only work if the task is broken down into smaller achievable parts, each with its own deadline. (How do you eat an elephant?)

Procrastination is the bad habit of putting off until the day after tomorrow what should have been done the day before yesterday.

If accountability works for you, tell everyone who’ll listen what you’re planning to do. Why do you think I did an announcement on all social media platforms that I was going to write a series of posts on behavioural biases? Because I knew I wouldn’t get round to doing it unless I made a public commitment to do so (I take my own medicine).

Let us know in the comments below.

I am passionate about helping people understand their behaviour with money and gently nudging them to spend less and save more. I have several academic journal publications on investor behaviour, financial literacy and personal finance, and perfectly understand the biases that influence how we manage our money. This blog is where I break down those ideas and share my thinking. I’ll try to cover relevant topics that my readers bring to my attention. Please read, share, and comment. That’s how we spread knowledge and help both ourselves and others to become in control of our financial situations.

Dr Gizelle Willows

PhD and NRF-rating in Behavioural Finance

[user_registration_form id=”8641″]

“Essentially, all models are wrong, but some are useful.” – George E.P. Box

Receive gentle nudges from us: